An Introduction to the GACC Quarantine Access of Imported Pet Food in China

By: Lin Fang(https://www.linkedin.com/in/fang-lin-fiona/)

Regulatory Analyst, Agrochemical Department

For businesses seeking to access the pet food market in China, there are two preconditions regarded as “must-have”: quarantine access from GACC (General Administration of Customs) and product registration with the MoARA. While registration requirements indicated by MoARA emphasize formulas’ scientific nature and quality safety, GACC market access is also affected by a number of additional factors that include: feed regulation enforcement efficiency within the sourcing countries, occurrence of plant and animal epidemics worldwide, as well as the economic and trade ties and underlying international political stability. All these are factors which may come into play when GACC issues its quarantine access, adding a high level of uncertainty to pet food importation.

Tohelp pet food companies better forecast the potential risk associated to this market and ensure accurate and informed decisions, this article will provide an overview of the context, mechanism, procedures and latest developments in GACC’s quarantine access inspection system.

The GACC’s market access syatem for imported pet food can be traced back to the “Administrative Measures for the Inspection and Quarantine Supervision on the Importation and Exportation of Feed and Feed Additives”, which was promulgated and implemented by the Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) until China’s ministerial restructuring in 2018 which transferred these duties to GACC. The importation of feed products, feed additives and plant/animal-sourced products for feeding purpose (feed materials) is subject to multiple varying factors , including product categorization, overseas producer/ Chinese importer registration, entry inspection, review on the regulatory system of the import origin countries/regions, risk monitoring and warning, etc.

1. White and Black Lists

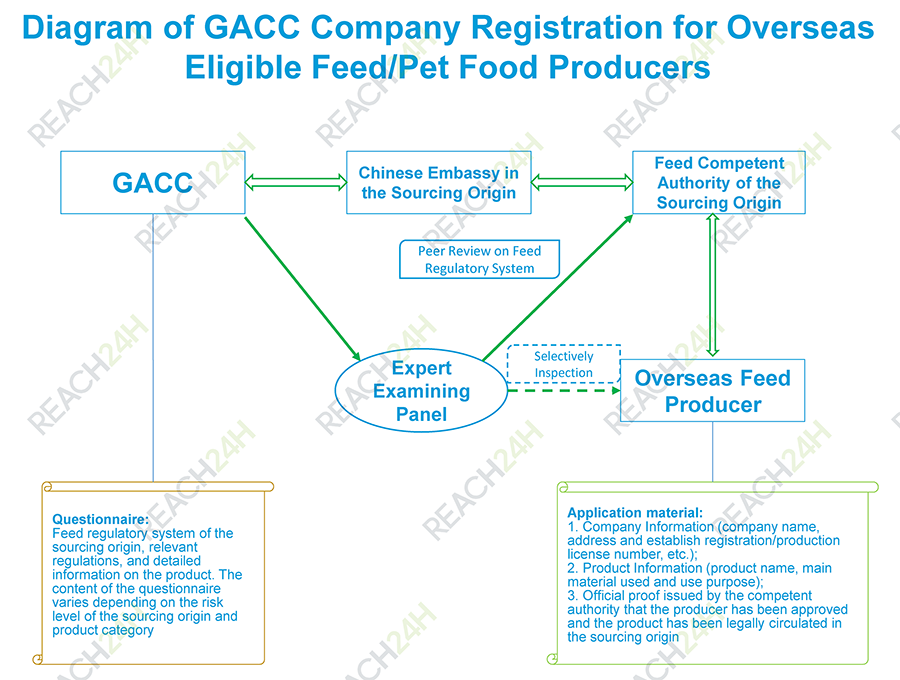

If the feed administrative authority from a sourcing origin country/region wishes to supply a specific feed (material) to China they need to negotiate with GACC the quarantine and sanitary requirements, and the inter-governmental negotiation will have to abide by the “Quarantine Access Procedures for Agricultural Products Firstly Imported into China”:

1. The feed administrative authority from the sourcing origin must produce a written application on the name, category, purpose of use, exporter and information on the Chinese importer.

2. China will deliver the sourcing origin a questionnaire on the import risk analysis (IRA) of the product;

3. China will deploy experts to analyze the information collected and request supplementary information or take an on-site investigation on the sourcing origin if needed;

4. Negotiation on the quarantine and sanitary requirements will be carried out, with a quarantine protocol signed at the end and enable trade to move forward;

The sourcing origins that have already supplied feed to China will be retrospectively reviewed. Decisions by the IRA and reviews will require have to be continuously updated onto the “List of Products and Sourcing Origin Countries/Regions Eligible for Feed and Feed Additives Importation”.

Feed producers or processing companies from these origins need to complete the company registration formality with the GACC through the nomination by the feed administrative authority of their respective countries. An examining panel will be sent to the origin country to later execute a review of the feed supervision system and random check on the producers. The final result of the investigation on producers will be made available on the GAAC’s website under the “List of Eligible Producers Registered with GACC for Importation”.

Only products registered by eligible producers are allowed to be imported into China, which provides a basic warranty that feed products from these origins/producers can satisfy the requirements comparable to the Chinese feed regulations.

Furthermore, a blacklist called “List of Animals, Animal Products and Sourcing Origins Prohibited from Importation” is annually updated based on the risk analysis and the epidemic warnings jointly issued by MoARA and GAAC. A pet food sourced from a GACC registered overseas producer may even be prohibited from importation if any of the animal-sourced ingredients used is included in the prohibitive list or epidemic warnings. The importation may only be resumed once MoARA and GACC officially declare the epidemic over.

3. Advances and Latest Updates on the Lists

On 1 Mar 2018, AQSIQ split the “List of Products and Sourcing Origin Countries/Regions Eligible for Feed and Feed Additives Importation” into the “List of Feed Additives, Additive Premix, Sourcing Origins Countries/Regions and Producers Eligible for Importation” and the “List of Feed Materials, Pet Food, Formula Feed and Sourcing Origin Eligible for Importation”. The latter was later adapted into the “List of Feed and Sourcing Origin Countries/Regions Eligible for Importation (Excluding Plant-sourced Feed)” and the “List of Grain Feedstuff and Sourcing Origin Countries/Regions Eligible for Importation”.

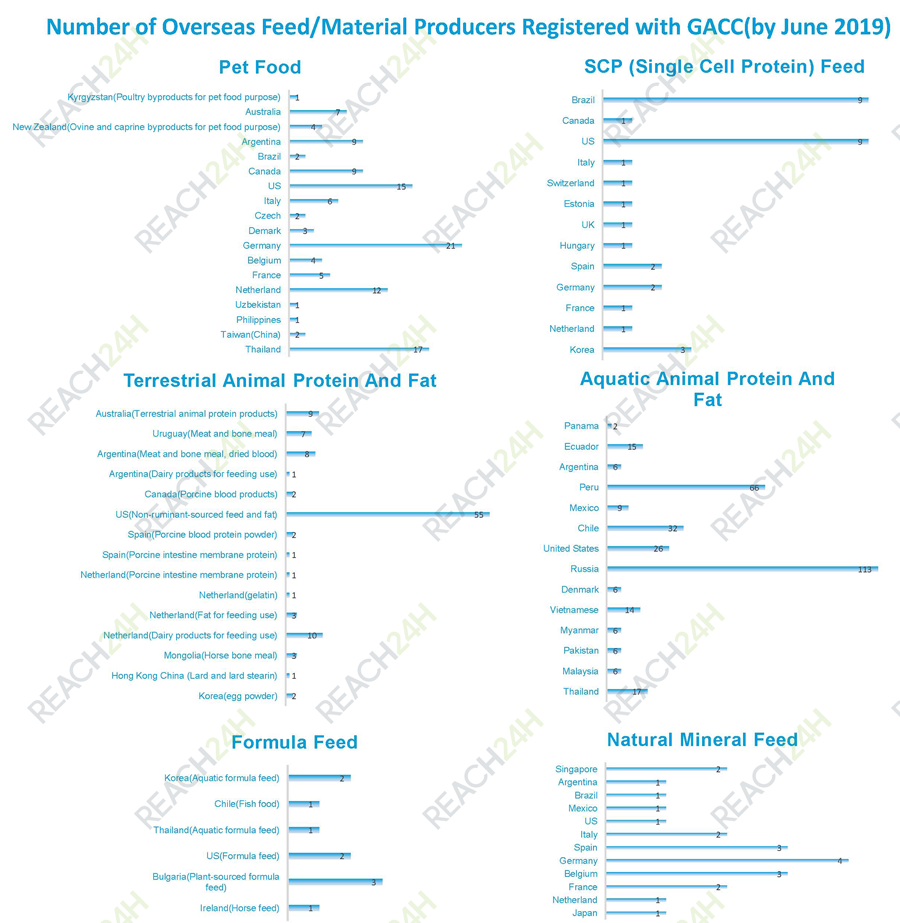

The “List of Feed and Sourcing Origin Countries/Regions Eligible for Importation (Excluding Plant-sourced Feed)” specifies the products for each sourcing origin. Registered overseas producers from these origins are further categorized into 6 sub-lists:

1. List of Overseas Formula Feed Producers Registered with GACC;

2. List of Overseas Natural Mineral Feed Producers Registered with GACC;

3. List of Overseas SCP (Single Cell Protein) Feed Producers Registered with GACC;

4. List of Overseas Pet Food Producers Registered with GACC;

5. List of Overseas Terrestrial Animal Protein and Fat Producers Registered with GACC;

6. List of Overseas Aquatic Animal Protein and Fat Producers Registered with GACC;

As of the end of June 2019, 292 overseas producers from 47 countries/regions obtained the GACC as eligible pet food and non-plant-sourced feed producers:

The latest “List of Animals, Animal Products and Sourcing Origins Prohibited from Importation” was updated on 18 Jun 2019. This list includes over 200 animal products from nearly 110 countries/regions which have been affected by 30 animal epidemics such as BSE (bovine spongiform encephalopathy), avian influenza, ASF (African swine fever) and FMD (foot-and-mouth disease). Over the past 12 months, GACC has lifted the injunction on the import of boneless beef (less than 30 months-old cattle) from UK and Czech Republic, poultry products from Germany and France, and artiodactyls animal products from Mongolia (partial area), Bolivia and South Africa, but ASF was most frequently warned and porcine products from Japan, Bulgaria, Belgium, Moldova, Mongolia, Vietnam, Cambodia and Chad were banned.

4. Traditional Trade and Cross-border Electronic Commerce CBEC

Depending on the product’s nature, epidemic risk, GAAC offers definite facilitation to specific product and sourcing origins from traditional trade channel. For example, French whey powder producers, U.S dairy producers, and New Zealand bone meal and pet food producers and Australian ruminant fat producers can complete their company registration after exporting their products to China. On 29 May 2018, GACC issued the Announcement 51 of 2018 according to which all canned dog/cat food became exempted from the “License of Inspection and Quarantine of Imported Plant and Animal Product”, a one-off or 3-month valid license required during each shipment of the goods.

Compared to regular trade, the CEBC (cross-border electronic commerce) business of pet food is rarely even. Despite pet food once being encouraged under China’s CEBC policy and a CEBC pet food pilot zone debuting in Hangzhou as early as 2017, we have witnessed 2 concerning events since then:

- In October 2017, China’s mail online shopping platformTaobao “suddenly” ordered online owners to remove foreign mail-ordered pet food, stating that these products were suspected to have breached quarantine requirements on plant/animal-sourced products;

- In April 2018, the National Monitoring Center of CEBC Product Quality Safety Risk circulated an official letter to CEBC websites including Tmall, NetEase Kaola and JD, etc. All CEBC websites were ordered to self-check pet food imported from U.S; products that failed to meet the “White and Black Lists” requirements were asked to be removed from the shops. North American pet food already account for 72% of China’s pet food importation, which means highly renowned U.S brands/retailers were greatly affected by this move. Among others, these included: CANIDAE, WELLNESS, ANNAMAET and PETCO. The search result of “U.S dog food” was even blocked on Weibo, Chinese microblogging website known as China’s twitter.

Conclusion

The 2018 incident involving U.S pet food has caused a flutter of speculation about Sino-US trade frictions, but the most fundamental reason is the late start of specific regulation targeting CEBC pet food.

The latest advances in the field of pet food regulations in China come from MoARA’s ministerial regulation (Announcement 20 of 2018): third-party trading platforms (including CEBC companies) are now obligated to implement the real-name registration of their distributors/retailers and must ensure all pet food sold online conforms to pet food regulations in force.